A) $0.40

B) $0.65

C) $0.70

D) $0.67

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

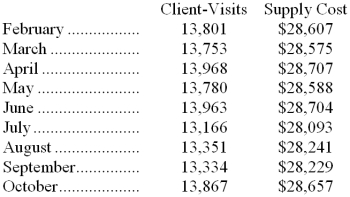

Supply costs at Rupard Corporation's chain of gyms are listed below:  Management believes that supply cost is a mixed cost that depends on client-visits. Using the high-low method to estimate the variable and fixed components of this cost, those estimates would be closest to:

Management believes that supply cost is a mixed cost that depends on client-visits. Using the high-low method to estimate the variable and fixed components of this cost, those estimates would be closest to:

A) $0.76 per client-visit; $18,152 per month

B) $1.31 per client-visit; $10,462 per month

C) $2.08 per client-visit; $28,489 per month

D) $0.77 per client-visit; $17,952 per month

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The contribution approach to the income statement:

A) organizes costs on a functional basis.

B) is useful to managers in planning and decision making.

C) shows a contribution margin rather than a net operating income figure at the bottom of the statement.

D) can be used only by manufacturing companies.

F) All of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

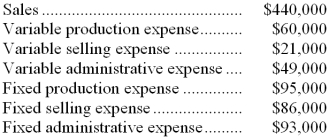

Kalbach Corporation, a manufacturing company, has provided the following financial data for November:  The company had no beginning or ending inventories. The contribution margin for November was:

The company had no beginning or ending inventories. The contribution margin for November was:

A) $285,000

B) $166,000

C) $310,000

D) $36,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At an activity level of 7,900 machine-hours in a month, Manchester Corporation's total variable maintenance cost is $430,550 and its total fixed maintenance cost is $417,120. -What would be the total variable maintenance cost at an activity level of 8,000 machine-hours in a month? Assume that this level of activity is within the relevant range.

A) $847,670

B) $422,400

C) $430,550

D) $436,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

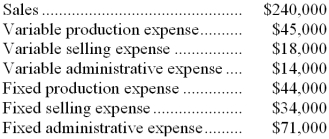

Pfalzgraf Corporation, a manufacturing company, has provided the following financial data for January:  The company had no beginning or ending inventories.

-The contribution margin for January was:

The company had no beginning or ending inventories.

-The contribution margin for January was:

A) $14,000

B) $151,000

C) $91,000

D) $163,000

F) B) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Contribution margin is the excess of revenues over:

A) cost of goods sold.

B) manufacturing cost.

C) all direct costs.

D) all variable costs.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Economists correctly point out that many costs that the accountant classifies as variable are actually curvilinear.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At an activity level of 7,900 machine-hours in a month, Manchester Corporation's total variable maintenance cost is $430,550 and its total fixed maintenance cost is $417,120. -What would be the average fixed maintenance cost per unit at an activity level of 8,000 units in a month? Assume that this level of activity is within the relevant range.

A) $52.14

B) $70.75

C) $52.80

D) $107.30

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The contribution approach to the income statement classifies costs by behavior rather than by function.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

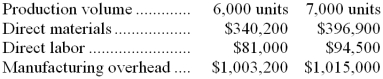

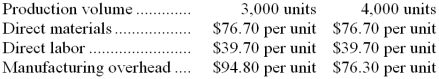

Baaca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  -The best estimate of the total variable manufacturing cost per unit is:

-The best estimate of the total variable manufacturing cost per unit is:

A) $82.00

B) $70.20

C) $56.70

D) $11.80

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Mateo Company's average cost per unit is $1.425 at the 16,000 unit level of activity and $1.38 at the 20,000 unit level of activity. Assume that all of the activity levels mentioned in this problem are within the relevant range. Required: Predict the following items for Mateo Company: a. Variable cost per unit. b. Total fixed cost per period. c. Total expected costs at the 18,000 unit level of activity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:  -The best estimate of the total monthly fixed manufacturing cost is:

-The best estimate of the total monthly fixed manufacturing cost is:

A) $222,000

B) $284,400

C) $305,200

D) $633,600

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

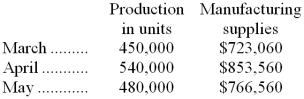

The controller of JoyCo has requested a quick estimate of the manufacturing supplies needed for the month of July when production is expected to be 470,000 units. Below are actual data from the prior three months of operations.  Using these data and the high-low method, what is the best estimate of the cost of manufacturing supplies that would be needed for July? (Assume that this activity is within the relevant range.)

Using these data and the high-low method, what is the best estimate of the cost of manufacturing supplies that would be needed for July? (Assume that this activity is within the relevant range.)

A) $805,284

B) $1,188,756

C) $755,196

D) $752,060

F) A) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

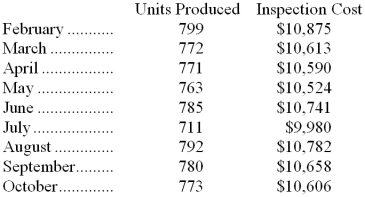

Inspection costs at one of Pulley Corporation's factories are listed below:  Management believes that inspection cost is a mixed cost that depends on units produced.

-Using the high-low method, the estimate of the fixed component of inspection cost per month is closest to:

Management believes that inspection cost is a mixed cost that depends on units produced.

-Using the high-low method, the estimate of the fixed component of inspection cost per month is closest to:

A) $2,749

B) $10,519

C) $9,980

D) $10,597

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

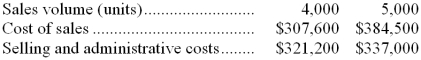

Iacopi Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $172.50 per unit.  The best estimate of the total contribution margin when 4,300 units are sold is:

The best estimate of the total contribution margin when 4,300 units are sold is:

A) $343,140

B) $65,790

C) $121,260

D) $411,080

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

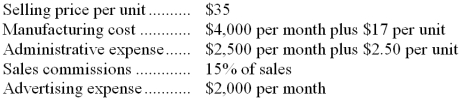

Buffo Company fabricates metal folding chairs. Data concerning the company's revenue and cost structure follow:  -If Buffo plans to produce and sell 3,000 units next month, the expected contribution margin would be:

-If Buffo plans to produce and sell 3,000 units next month, the expected contribution margin would be:

A) $30,750

B) $74,250

C) $26,750

D) $96,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Expense A is a fixed cost; expense B is a variable cost. During the current year the activity level has increased, but is still within the relevant range. In terms of cost per unit of activity, we would expect that:

A) expense A has remained unchanged.

B) expense B has decreased.

C) expense A has decreased.

D) expense B has increased.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At an activity level of 10,000 units, variable costs totaled $35,000 and fixed costs totaled $20,800. If 16,000 units are produced and this activity is within the relevant range, then:

A) total cost would equal $89,280.

B) total unit cost would equal $4.80.

C) fixed cost per unit would equal $5.58.

D) total costs would equal $55,800.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maxwell Company has a total expense per unit of $2.00 per unit at the 16,000 level of activity and total expense per unit of $1.95 at the 21,000 unit level of activity. -The best estimate of the total fixed cost per period for Maxwell Company is:

A) $40,950

B) $32,000

C) $3,360

D) $29,190

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 119

Related Exams