B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

BLW Corporation is considering the terms to be set on the options it plans to issue to its executives. Which of the following actions would decrease the value of the options, other things held constant?

A) The exercise price of the option is increased.

B) The life of the option is increased, i.e., the time until it expires is lengthened.

C) The Federal Reserve takes actions that increase the risk-free rate.

D) BLW's stock price becomes more risky (higher variance) .

E) BLW's stock price suddenly increases.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you believe that Basso Inc.'s stock price is going to increase from its current level of $22.50 sometime during the next 5 months. For $3.10 you can buy a 5-month call option giving you the right to buy 1 share at a price of $25 per share. If you buy this option for $3.10 and Basso's stock price actually rises to $45, what would your pre-tax net profit be?

A) −$3.10

B) $16.90

C) $17.75

D) $22.50

E) $25.60

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Call options give investors the right to sell a stock at a certain strike price before a specified date.

B) Options typically sell for less than their exercise value.

C) LEAPS are very short-term options that were created relatively recently and now trade in the market.

D) An option holder is not entitled to receive dividends unless he or she exercises their option before the stock goes ex dividend.

E) Put options give investors the right to buy a stock at a certain strike price before a specified date.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Because of the time value of money, the longer before an option expires, the less valuable the option will be, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If we define the "premium" on an option to be the difference between the price at which an option sells and the exercise value (or the difference between the stock's current market price and the strike price), then we would expect the premium to increase as the stock price increases, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct, holding other things constant, for XYZ Corporation's traded call options?

A) The higher the strike price on XYZ's options, the higher the option's price will be.

B) Assuming the same strike price, an XYZ call option that expires in one month will sell at a higher price than one that expires in three months.

C) If XYZ's stock price stabilizes (becomes less volatile) , then the price of its options will increase.

D) If XYZ pays a dividend, then its option holders will not receive a cash payment, but the strike price of the option will be reduced by the amount of the dividend.

E) The price of these call options is likely to rise if XYZ's stock price rises.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you believe that Florio Company's stock price is going to decline from its current level of $82.50 sometime during the next 5 months. For $5.10 you could buy a 5-month put option giving you the right to sell 1 share at a price of $85 per share. If you bought this option for $5.10 and Florio's stock price actually dropped to $60, what would your pre-tax net profit be?

A) −$5.10

B) $19.90

C) $20.90

D) $22.50

E) $27.60

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the current price of a stock is below the strike price, then an option to buy the stock is worthless and will have a zero value.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

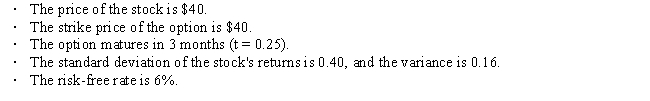

An analyst wants to use the Black-Scholes model to value call options on the stock of Heath Corporation based on the following data: Given this information, the analyst then calculated the following necessary components of the Black-Scholes model:

N(d1) and N(d2) represent areas under a standard normal distribution function. Using the Black-Scholes model, what is the value of the call option?

N(d1) and N(d2) represent areas under a standard normal distribution function. Using the Black-Scholes model, what is the value of the call option?

A) $2.81

B) $3.12

C) $3.47

D) $3.82

E) $4.20

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current price of a stock is $22, and at the end of one year its price will be either $27 or $17. The annual risk-free rate is 6.0%, based on daily compounding. A 1-year call option on the stock, with an exercise price of $22, is available. Based on the binomial model, what is the option's value? (Hint: Use daily compounding.)

A) $2.43

B) $2.70

C) $2.99

D) $3.29

E) $3.62

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Call options generally sell at a price greater than their exercise value, and the greater the exercise value, the higher the premium on the option is likely to be.

B) Call options generally sell at a price below their exercise value, and the greater the exercise value, the lower the premium on the option is likely to be.

C) Call options generally sell at a price below their exercise value, and the lower the exercise value, the lower the premium on the option is likely to be.

D) Because of the put-call parity relationship, under equilibrium conditions a put option on a stock must sell at exactly the same price as a call option on the stock.

E) If the underlying stock does not pay a dividend, it does not make good economic sense to exercise a call option prior to its expiration date, even if this would yield an immediate profit.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Because of the put-call parity relationship, under equilibrium conditions a put option on a stock must sell at exactly the same price as a call option on the stock, provided the strike prices for the put and call are the same.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Braddock Construction Co.'s stock is trading at $20 a share. Call options that expire in three months with a strike price of $20 sell for $1.50. Which of the following will occur if the stock price increases 10%, to $22 a share?

A) The price of the call option will increase by more than $2.

B) The price of the call option will increase by less than $2, and the percentage increase in price will be less than 10%.

C) The price of the call option will increase by less than $2, but the percentage increase in price will be more than 10%.

D) The price of the call option will increase by more than $2, but the percentage increase in price will be less than 10%.

E) The price of the call option will increase by $2.

G) All of the above

Correct Answer

verified

C

Correct Answer

verified

True/False

If a company announces a change in its dividend policy from a zero target payout ratio to a 100% payout policy, this action could be expected to increase the value of long-term options (say 5-year options) on the firm's stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An option that gives the holder the right to sell a stock at a specified price at some future time is

A) a put option.

B) an out-of-the-money option.

C) a naked option.

D) a covered option.

E) a call option.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current price of a stock is $50, the annual risk-free rate is 6%, and a 1-year call option with a strike price of $55 sells for $7.20. What is the value of a put option, assuming the same strike price and expiration date as for the call option?

A) $7.33

B) $7.71

C) $8.12

D) $8.55

E) $9.00

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the market is in equilibrium, then an option must sell at a price that is exactly equal to the difference between the stock's current price and the option's strike price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor who writes standard call options against stock held in his or her portfolio is said to be selling what type of options?

A) Put

B) Naked

C) Covered

D) Out-of-the-money

E) In-the-money

G) A) and E)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) As the stock's price rises, the time value portion of an option on a stock increases because the difference between the price of the stock and the fixed strike price increases.

B) Issuing options provides companies with a low cost method of raising capital.

C) The market value of an option depends in part on the option's time to maturity and also on the variability of the underlying stock's price.

D) The potential loss on an option decreases as the option sells at higher and higher prices because the profit margin gets bigger.

E) An option's value is determined by its exercise value, which is the market price of the stock less its striking price. Thus, an option can't sell for more than its exercise value.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 28

Related Exams