Filters

Question type

A) Net worth plus assets equal liabilities.

B) Assets plus liabilities equal net worth.

C) Assets equal liabilities plus net worth.

D) Assets plus reserves equal net worth.

E) A) and B)

F) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Question 152

True/False

Commercial banks increase the supply of money when they purchase either personal IOUs or government bonds from businesses and households.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 153

Multiple Choice

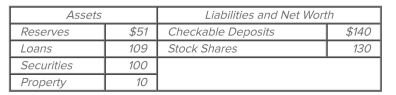

Refer to the accompanying consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 30 percent. All figures are in billions. The maximum amount by which the commercial banking

System can expand the supply of money by lending is

Refer to the accompanying consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 30 percent. All figures are in billions. The maximum amount by which the commercial banking

System can expand the supply of money by lending is

A) $30 billion.

B) $23.1 billion.

C) $27 billion.

D) $15 billion.

E) C) and D)

F) A) and D)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Question 154

Multiple Choice

A commercial bank has excess reserves of $10,000 and a required reserve ratio of 20 percent. It grants a loan of $8,000 to a customer, who then writes out a check for $8,000 that is deposited in another bank. The first bank will find its reserves decrease by

A) $2,000.

B) $3,000.

C) $1,600.

D) $8,000.

E) None of the above

F) B) and D)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Question 155

Multiple Choice

If m equals the maximum number of new dollars that can be created for a single dollar of excess reserves and R equals the required reserve ratio, then for the banking system,

A) m = R ? 1.

B)

C) R = m ? 1.

D)

E) None of the above

F) A) and B)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 285 of 285

Related Exams